Page 63 of 97

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Thu Dec 17, 2020 10:24 am

by LawBeefaroni

For entertainment today:

OCG

SCPS

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Thu Dec 17, 2020 10:43 am

by LordMortis

OCG. Is that the IPO they were asking if the SEC is going to get involved for this morning on CNBC?

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Thu Dec 17, 2020 10:55 am

by LawBeefaroni

Didn't see CNBC this morning, had a call..

Only SEC news I've seen today is about them going after Robinhood. Robinhood is looking to IPO so that may have been it.

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Thu Dec 17, 2020 11:31 am

by LordMortis

10:15 am ET

*Scopus BioPharma Shares Resume Trading, Halted On Circuit Breaker; Up 650%

Benzinga

9:42 am ET

*Scopus BioPharma Shares Halted On Circuit Breaker; Shares Up 371%

Benzinga

9:32 am ET

*Scopus Biopharma Shares Halted On Circuit Breaker; Up 287%

Price

$41.14

Prev Close

5.92

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Thu Dec 17, 2020 11:48 am

by LawBeefaroni

LordMortis wrote: ↑Thu Dec 17, 2020 11:31 am

10:15 am ET

*Scopus BioPharma Shares Resume Trading, Halted On Circuit Breaker; Up 650%

Benzinga

9:42 am ET

*Scopus BioPharma Shares Halted On Circuit Breaker; Shares Up 371%

Benzinga

9:32 am ET

*Scopus Biopharma Shares Halted On Circuit Breaker; Up 287%

Price

$41.14

Prev Close

5.92

Check out all the LDUP halts today. Not just SCPS either. Crazy times.

https://www.nasdaqtrader.com/trader.aspx?id=TradeHalts#

Then take a look at a 15 year chart of the CBOE equity put/call ratio.

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Thu Dec 17, 2020 1:32 pm

by LordMortis

LordMortis wrote: ↑Tue Dec 15, 2020 2:05 pm

If I has $4000 laying around (like I ever have $4000 laying around) I'd be tempted buy MLHR and sell a $2 option at $40 for Friday. Worst case scenario is I'd get a $2 discount on a stock I'd already been watching anyway (which would pay for it's $1.84 jump today based on earnings being announced tomorrow)

And that would have been a bad call.

Price

$35.18

Day's Change

-5.38 (-13.26%)

Herman Miller shares are trading lower after the company reported Q2 earnings results.

EPS up $.01 year over year Stock down $7+ YOY.

The earning disappointment?

Announced December 16, 2020 $0.89 Q2 Consensus

of 3 analysts $0.56 Difference from

consensus

37.08%

Of course, today if I had $3500 laying around I'd buy and put up $.60 $40 option for January.

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Thu Dec 17, 2020 4:12 pm

by LordMortis

Zaxxon wrote: ↑Tue Dec 08, 2020 2:55 pm

LordMortis wrote: ↑Tue Dec 08, 2020 2:37 pm

Pushed out most of my Dec 18th covered call to April 16th, taking token amounts of profit but increasing their call price.

ADT

ADTN

VZ

VTI

HBAN

I still have DEC 18 very expensive to buy back covered calls for F, VT, and SPY but I'm not comfortable with pushing them out yet. However, as every call I have is ITM (in the money), I don't want to with until the last minute on everything and then find I don't have time during a workday to play amateur investor and accidentally let all my calls hit strike price and have to pay taxes on selling off just about everything.

Since you're rolling (I'm assuming out and up?) ITM covered calls, are you familiar with the qualified/unqualified rules on calls? If you're not careful, you can end up tolling the holding period and have short-term gain tax treatment even if you've held the underlying shares for more than a year.

[Edit to add that if you've already held the underlying shares for a year when you opened the call position against them, this is all something you don't have to worry about.]

On the 8th of December I had thought I had safely moved everything to OTM into friggen April. 9 days go by and everything but HBAN is back ITM. This market is crazy. And the TV on in the background, is all like "No. This isn't the ceiling. This isn't 1999. All the indicators are that our growth matches coming out of a recession and closer to 2009 than 1999. Oh, and you should probably increase you BitCoin." I mean I can't complain because this is money in pocket, not just money on paper, though I'm eventually going to forced to sell stuff well under market because I can't keep up.

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Thu Dec 17, 2020 4:26 pm

by LawBeefaroni

LawBeefaroni wrote: ↑Thu Dec 17, 2020 10:24 am

For entertainment today:

OCG

SCPS

Hoodies getting smoked on OCG. SCPS has been a daytrader's dream all day.

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Thu Dec 17, 2020 4:45 pm

by Carpet_pissr

What am I missing with Robinhood? What does it offer that other platforms don't? Everything I see at the top level just mentions free trades, which almost everyone has been doing for at least a couple of years now.

Is it that they are playing on the hoped for common idea that all the brokers USED to charge trading fees (even though it's largely no longer true)?

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Thu Dec 17, 2020 4:51 pm

by Zaxxon

Carpet_pissr wrote: ↑Thu Dec 17, 2020 4:45 pm

What am I missing with Robinhood? What does it offer that other platforms don't? Everything I see at the top level just mentions free trades, which almost everyone has been doing for at least a couple of years now.

Is it that they are playing on the hoped for common idea that all the brokers USED to charge trading fees (even though it's largely no longer true)?

Fractional shares (though I know some other brokerages are doing those now)?

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Thu Dec 17, 2020 5:09 pm

by LawBeefaroni

Carpet_pissr wrote: ↑Thu Dec 17, 2020 4:45 pm

What am I missing with Robinhood? What does it offer that other platforms don't? Everything I see at the top level just mentions free trades, which almost everyone has been doing for at least a couple of years now.

Is it that they are playing on the hoped for common idea that all the brokers USED to charge trading fees (even though it's largely no longer true)?

They gameify the crap out of it.

They don't disclose how they make their money (selling orders).

Their KYC is a joke.

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Thu Dec 17, 2020 5:15 pm

by LordMortis

LawBeefaroni wrote: ↑Thu Dec 17, 2020 5:09 pm

Carpet_pissr wrote: ↑Thu Dec 17, 2020 4:45 pm

What am I missing with Robinhood? What does it offer that other platforms don't? Everything I see at the top level just mentions free trades, which almost everyone has been doing for at least a couple of years now.

Is it that they are playing on the hoped for common idea that all the brokers USED to charge trading fees (even though it's largely no longer true)?

They gameify the crap out of it.

They don't disclose how they make their money (selling orders).

Their KYC is a joke.

I think he was asking for the attraction. And it was they gave you stuff for joining, fractional shares, and free trading. I am told it also used psychology in UI to encourage you to be an active trader, using many of the same design queues you get from casinos and slot machines. They set the market for free trading as far as I know, but yeah as to the seedy side...

https://www.cnbc.com/2020/12/17/sec-cha ... money.html

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Thu Dec 17, 2020 5:21 pm

by Carpet_pissr

LawBeefaroni wrote: ↑Thu Dec 17, 2020 5:09 pm

Carpet_pissr wrote: ↑Thu Dec 17, 2020 4:45 pm

What am I missing with Robinhood? What does it offer that other platforms don't? Everything I see at the top level just mentions free trades, which almost everyone has been doing for at least a couple of years now.

Is it that they are playing on the hoped for common idea that all the brokers USED to charge trading fees (even though it's largely no longer true)?

They gameify the crap out of it.

Ah, ok. That explains why I keep hearing that it's mostly new/young investors.

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Thu Dec 17, 2020 5:26 pm

by LawBeefaroni

LordMortis wrote: ↑Thu Dec 17, 2020 5:15 pm

LawBeefaroni wrote: ↑Thu Dec 17, 2020 5:09 pm

Carpet_pissr wrote: ↑Thu Dec 17, 2020 4:45 pm

What am I missing with Robinhood? What does it offer that other platforms don't? Everything I see at the top level just mentions free trades, which almost everyone has been doing for at least a couple of years now.

Is it that they are playing on the hoped for common idea that all the brokers USED to charge trading fees (even though it's largely no longer true)?

They gameify the crap out of it.

They don't disclose how they make their money (selling orders).

Their KYC is a joke.

I think he was asking for the attraction. And it was they gave you stuff for joining, fractional shares, and free trading. I am told it also used psychology in UI to encourage you to be an active trader, using many of the same design queues you get from casinos and slot machines. They set the market for free trading as far as I know, but yeah as to the seedy side...

https://www.cnbc.com/2020/12/17/sec-cha ... money.html

The gamification is the UI you mention. There is freaking confetti when you make a sale.

https://www.ft.com/content/0e451231-fa4 ... e107f337b9

Robinhood has been accused of blurring the boundaries between an easy to use customer interface and gamification, which encourages trading with email alerts and in-app prompts encouraging customers towards more complex, higher-risk investment products. When trades are completed on the platform, customers are sent emoji-laden messages prompting them to purchase additional shares.

Academics found that, because the platform highlights top-performing shares, investors are drawn to buy those popular stocks, driving up prices and hurting their returns.

“Half of Robinhood users are first-time investors,” a group of researchers led by Brad Barber at the University of California, Davis, wrote in a paper in November. “Inexperienced stock investors are likely to be more heavily influenced by attention and by biases that led to return chasing.”

Also, the crappy KYC is attractive to inexperienced, unqualified players just like a liquor store that doesn't card is attractive to underage drinkers.

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Thu Dec 17, 2020 6:03 pm

by Carpet_pissr

What is KYC? Know Your Client?

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Thu Dec 17, 2020 6:23 pm

by Isgrimnur

Carpet_pissr wrote: ↑Thu Dec 17, 2020 6:03 pm

What is KYC? Know Your Client?

Yes.

https://en.wikipedia.org/wiki/Know_your_customer

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Thu Dec 17, 2020 7:36 pm

by pr0ner

No one I know who is a serious investor is on Robinhood.

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Fri Dec 18, 2020 12:02 am

by Kraken

Some while ago, when the Dow was around 25,000, I moved 1/3 of our retirement money from equities to money markets in anticipation of the economic difficulties and social unrest that did, in fact, occur as I expected. What I didn't expect is that the stock markets don't care what's happening to the hoi polloi; they just kept going up despite the lower classes' suffering. So last week I declared my lesson learned and reinvested the cash. Vanguard had introduced some new "socially conscious" stock and bond funds, so I put our money there. My hunch says they will prosper in the Biden economy. And my hunches are always so good.

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Fri Dec 18, 2020 7:05 pm

by Zaxxon

As expected, today was a crazy day for TSLA. Wound up closing its last day outside the S&P 500 at $695, and in the last 5ish minutes that ranged from $630s on up. Something like 70M shares traded in the final minute.

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Tue Dec 22, 2020 10:40 am

by LawBeefaroni

SPWH taken private. Have traded SPWH but missed the 35% pop. However, it's seems to have helped VSTO, which I'm currently long and green. May be time to sell?

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Tue Dec 22, 2020 11:11 am

by LawBeefaroni

Double post.

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Tue Dec 22, 2020 11:29 am

by LawBeefaroni

And there goes GME.

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Tue Dec 22, 2020 11:31 am

by LordMortis

LawBeefaroni wrote: ↑Tue Dec 22, 2020 11:29 am

And there goes GME.

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Tue Dec 22, 2020 1:10 pm

by LawBeefaroni

LawBeefaroni wrote: ↑Tue Dec 22, 2020 10:40 am

SPWH taken private. Have traded SPWH but missed the 35% pop. However, it's seems to have helped VSTO, which I'm currently long and green. May be time to sell?

VSTO was up 7% when I posted. Glad I didn't sell then.

These markets are insane.

POWW making me regret taking some off yesterday.

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Fri Dec 25, 2020 2:53 pm

by LawBeefaroni

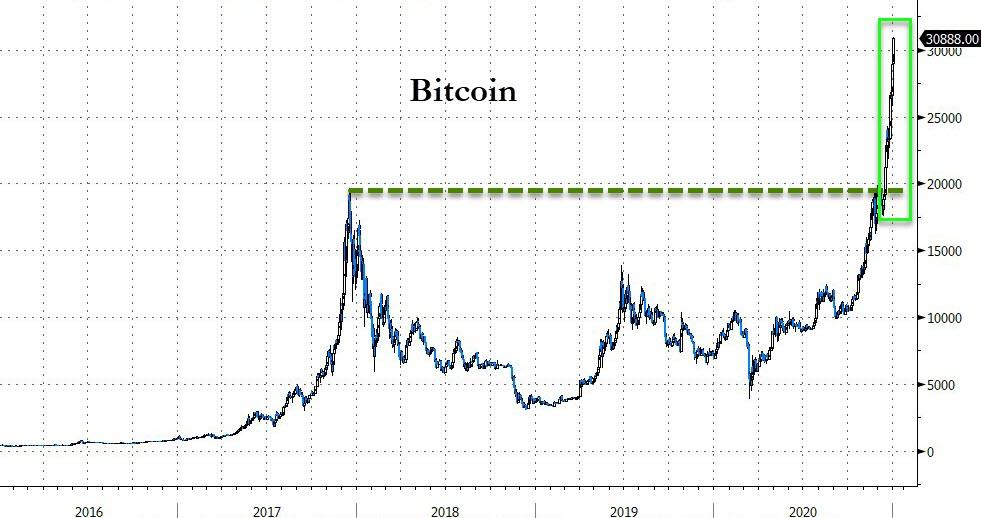

BTC $24.5K.

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Sat Dec 26, 2020 12:03 pm

by LawBeefaroni

BTC $25.6K.

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Sat Dec 26, 2020 12:57 pm

by Zaxxon

Overlords Bitcoin Speculation [OBS] Recruitment Thread?

In related news, I took some TSLA off the table on Christmas Eve, so expect 700 soon...

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Sun Dec 27, 2020 4:52 am

by LawBeefaroni

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Sun Dec 27, 2020 9:38 am

by Zaxxon

Amazing. Are you still holding any?

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Sun Dec 27, 2020 1:49 pm

by LawBeefaroni

Zaxxon wrote: ↑Sun Dec 27, 2020 9:38 am

Amazing. Are you still holding any?

I have some. Not a trade for me, more diversification at this point. If the thesis is correct it's a good idea to have in the portfolio.

Not buying more right now but I expect at least a 30% drop before the next run.

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Sat Jan 02, 2021 9:55 am

by LawBeefaroni

BTC $31.2K.

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Sat Jan 02, 2021 4:20 pm

by LawBeefaroni

BTC $33K.

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Sat Jan 02, 2021 6:14 pm

by pr0ner

Insane.

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Sun Jan 03, 2021 9:29 pm

by LawBeefaroni

ETH $1K.

This is just nuts.

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Mon Jan 04, 2021 7:53 am

by LordMortis

LordMortis wrote: ↑Mon Jan 04, 2021 7:52 am

LordMortis wrote: ↑Thu Aug 20, 2020 3:43 pm

I was going to (and didn't) invest in CELH at $11 at the tale end of June.

$50.31

I guess it's coming off the watchlist now.

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Mon Jan 04, 2021 1:09 pm

by LordMortis

Put my new Roth IRA money to use this morning. Put in a sliding scale to pick up shares of VT and SPY during the inevitable pullback. Did not think that pull back would be today, nor that I would pick up all my bids before lunch. The market is dipping low enough that non IRA account is staring to pick up one share of VTI per dollar drop. 2% is hardly a correction, as it only take us back to way back to right before Christmas but I do have to wonder if this is the beginning. My not so smart crystal ball is set up to pick up shares a one dollar dip at a time all the way down $172. $172 being the point where I thought "Really? We're showing strength, now? Really? Based on..." and I continued to watch it go from 172 to 195 in less than two months. That money would probably be better suited for a CD but CDs pay... nothing...

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Mon Jan 04, 2021 1:40 pm

by coopasonic

Zaxxon wrote: ↑Sat Dec 26, 2020 12:57 pm

Overlords Bitcoin Speculation [OBS] Recruitment Thread?

In related news, I took some TSLA off the table on Christmas Eve, so expect 700 soon...

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Mon Jan 04, 2021 1:41 pm

by Zaxxon

coopasonic wrote: ↑Mon Jan 04, 2021 1:40 pm

Zaxxon wrote: ↑Sat Dec 26, 2020 12:57 pm

Overlords Bitcoin Speculation [OBS] Recruitment Thread?

In related news, I took some TSLA off the table on Christmas Eve, so expect 700 soon...

I do what I can.

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Mon Jan 04, 2021 1:56 pm

by LordMortis

I don't think anyone who bought in over a year ago and sold some of their position for over $600 post 5for1 can spend too much effort ruminating in what might have been.

For Bitcoin, I got nuthin'. I wouldn't know how to buy in and I'm sure the wheel would stop (and fall off) right after I did anyway. A lot of people quintupled their money in 2020 when the world made no sense. I have no idea what the repercussions will be but I still can't get anywhere near it.

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Mon Jan 04, 2021 2:49 pm

by pr0ner

It's wild that even after how bad the stock market crashed in February/March, my retirement account looks to be up a bit over 20% (don't have the exact number yet, but my rough calculation is 21.5%) for 2020.