Page 43 of 97

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Mon Jul 16, 2018 12:22 pm

by LordMortis

Isgrimnur wrote: ↑Mon Jul 16, 2018 12:09 pm

All of my Roth IRA contributions are sitting in cash. I haven't made a purchase since October. That purchase (IVV) is up 8.67% since then, however, so perhaps I should reconsider.

Maybe after 3Q results start showing tariff results.

My 401k is pre-determined and hasn't changed in few years.

I put my Roth IRA in right about 2nd January. Though that will change with TD Ameritrade who have delays on ACH

My personal savings is all going into CDs right now. I'm transferring my existing "cash" mostly out of a crappy credit unions money market, bit by bit. I figure for now I'm going to to build a two year CD ladder that I will just keep cycling. Even with my existing savings that's going to take some time.

By the time I finish, that should put my non, cant touch it until 59.5, retirement portfolio at about 70% securities 30% "cash" unless the market hustles in one direction or another. Not sure when I will hit that objective. When I do, I'll go back and re-visit if it's time to start building securities again and at what pace. I will have essentially raided my stagnant "new car fund" to build my CD Ladder, so my comfort may be all out of whack. My emergency liquid nest egg will have gone form considerable (given my means) to small down payment on something big when I am done.

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Mon Jul 16, 2018 3:39 pm

by Carpet_pissr

malchior wrote: ↑Mon Jul 16, 2018 11:48 am

Carpet_pissr wrote: ↑Fri Jun 29, 2018 4:09 pm

I went to about 30% cash a week or so ago...

Is the world ending.

Serious though I get the urge to go hard to cash. I however am just going to ride my diversified portfolio. I market timed correctly once when I saw the crash coming a long way out in 2008 and went almost 100% bonds/cash in August of that year. I'm going to assume I'll never get close to that lucky ever again. Therefore, I'll just continue to monthly allocate 401k and investment cash to a basket of stocks/etfs/bonds/alternative investments/etc. and plan to just ride the dips and rises. At some point it became too much.

I also try to avoid timing the market for anything, but this bull market is so long in the tooth, that I feel compelled. Also had to consider the ridiculous returns for several holdings like Amazon and Priceline - that shouldn't matter, really, but psychologically it does.

I'm happy to miss out on some gains (already have) with 30-40% cash on hand and wait til the next big correction or bear market to buy again. I should note this is the first time I have ever gone to this much cash (%-wise).

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Tue Jul 17, 2018 3:20 pm

by noxiousdog

Carpet_pissr wrote: ↑Fri Jun 29, 2018 4:09 pm

I went to about 30% cash a week or so ago...sold a few shares of AMZN as well as CVS. Looks like a great buying opportunity for CVS, IF you believe, like many analysts do, that AMZN can't possibly "solve" a problem like healthcare. I honestly don't know. I know that it's not like breaking into retail, or media content. It's a whole 'nother beast, with relationships at high levels required, etc.

We'll see.

Thank you for the CVS mention. It's trading at 13.5 times 2017 earnings with decent growth expectations. Even a modest multiple gain to 15 would give a 56% return by 2018 earnings season.

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Tue Jul 17, 2018 3:51 pm

by Carpet_pissr

noxiousdog wrote: ↑Tue Jul 17, 2018 3:20 pm

Carpet_pissr wrote: ↑Fri Jun 29, 2018 4:09 pm

I went to about 30% cash a week or so ago...sold a few shares of AMZN as well as CVS. Looks like a great buying opportunity for CVS, IF you believe, like many analysts do, that AMZN can't possibly "solve" a problem like healthcare. I honestly don't know. I know that it's not like breaking into retail, or media content. It's a whole 'nother beast, with relationships at high levels required, etc.

We'll see.

Thank you for the CVS mention. It's trading at 13.5 times 2017 earnings with decent growth expectations. Even a modest multiple gain to 15 would give a 56% return by 2018 earnings season.

My problem with CVS is that I am unsure about the effect that the new Amazon/Berkshire Hath/JP Morgan JV will have, especially with recent comments by the CEO stating their goal is to "Take some of the middlemen out of the system’

When this was first announced, CVS et al dropped, then came back a bit because it wasn't clear if the new JV was only interested in the healthcare for three companies' employees, or if it was external as well. Seems now like their scope is broader, so yes, I'm a bit worried (and probably should be for my Express Scripts shares as well).

Finally, I cannot stand doing business with CVS as a customer. I hate that place.

Doesn't really factor into my investment thesis, but it's definitely there in the back of my mind every time I step foot in there. Ugh.

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Tue Jul 17, 2018 4:00 pm

by noxiousdog

Carpet_pissr wrote: ↑Tue Jul 17, 2018 3:51 pm

noxiousdog wrote: ↑Tue Jul 17, 2018 3:20 pm

Carpet_pissr wrote: ↑Fri Jun 29, 2018 4:09 pm

I went to about 30% cash a week or so ago...sold a few shares of AMZN as well as CVS. Looks like a great buying opportunity for CVS, IF you believe, like many analysts do, that AMZN can't possibly "solve" a problem like healthcare. I honestly don't know. I know that it's not like breaking into retail, or media content. It's a whole 'nother beast, with relationships at high levels required, etc.

We'll see.

Thank you for the CVS mention. It's trading at 13.5 times 2017 earnings with decent growth expectations. Even a modest multiple gain to 15 would give a 56% return by 2018 earnings season.

My problem with CVS is that I am unsure about the effect that the new Amazon/Berkshire Hath/JP Morgan JV will have, especially with recent comments by the CEO stating their goal is to "Take some of the middlemen out of the system’

When this was first announced, CVS et al dropped, then came back a bit because it wasn't clear if the new JV was only interested in the healthcare for three companies' employees, or if it was external as well. Seems now like their scope is broader, so yes, I'm a bit worried (and probably should be for my Express Scripts shares as well).

Finally, I cannot stand doing business with CVS as a customer. I hate that place.

Doesn't really factor into my investment thesis, but it's definitely there in the back of my mind every time I step foot in there. Ugh.

I'll believe it when I see it. They have two ways of doing it. 1) hiring pharmacists or 2) automation. I don't think automation will get approval.

Express Scripts could be worried, but I can't see the local pharmacies having impact for a long time.

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Tue Jul 17, 2018 4:32 pm

by LawBeefaroni

It's about PBM, not selling drugs. Anyone can sell drugs.

Not sure off the top of my head but maybe $40B of CVS revenue is Caremark PBM. That's a big chunk at risk and that's the gamble with CVS (and ESRX and RAD) wrt the Amazon group.

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Tue Jul 17, 2018 5:03 pm

by LordMortis

I put money in to CVS around $100 a share and have watched it tumble on Amazon and chagnes to pharm distribution news ever since, irrespective of profit and physical space market share. I am loathe to put any more money in. They're still paying $.50 a share a quarter though, so my little shares are going nowhere and at least are collecting toppins.

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Tue Jul 17, 2018 9:50 pm

by Carpet_pissr

LawBeefaroni wrote: ↑Tue Jul 17, 2018 4:32 pm

It's about PBM, not selling drugs.

Yep.

Side note: I think I bought even more CVS after that first hit when the JV was announced, because I thought its intentions were misunderstood by the market. People see AMAZON TO GET INTO HEALTHCARE in a headline and shit falls apart. "Amazon to form JV to improve healthcare for its employees" has a very different effect. I was thinking the latter, but with the latest news, seems like they are planning to go external. Lots of doubters out there that they can pull it off, as well, due to complexity and relationships necessary. i.e. they can't just BUY their way into being a huge player in that complex space (I happen to disagree...anyone heard of poaching?!)

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Wed Jul 18, 2018 9:12 am

by noxiousdog

LordMortis wrote: ↑Tue Jul 17, 2018 5:03 pm

I put money in to CVS around $100 a share and have watched it tumble on Amazon and chagnes to pharm distribution news ever since, irrespective of profit and physical space market share. I am loathe to put any more money in. They're still paying $.50 a share a quarter though, so my little shares are going nowhere and at least are collecting toppins.

In 2016 you paid $100 for $5.21 of earnings. Today if you paid $100, you get $8.68.

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Wed Jul 18, 2018 12:29 pm

by LordMortis

noxiousdog wrote: ↑Wed Jul 18, 2018 9:12 am

In 2016 you paid $100 for $5.21 of earnings. Today if you paid $100, you get $8.68.

I'm not getting those earnings.

I'm getting a monthly decrease in the value for selling my stock and $.50 per share per quarter.

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Wed Jul 18, 2018 12:31 pm

by noxiousdog

LordMortis wrote: ↑Wed Jul 18, 2018 12:29 pm

noxiousdog wrote: ↑Wed Jul 18, 2018 9:12 am

In 2016 you paid $100 for $5.21 of earnings. Today if you paid $100, you get $8.68.

I'm not getting those earnings.

I'm getting a monthly decrease in the value for selling my stock and $.50 per share per quarter.

Yes, you are. They legally belong to you.

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Wed Jul 18, 2018 3:16 pm

by LawBeefaroni

noxiousdog wrote: ↑Wed Jul 18, 2018 12:31 pm

LordMortis wrote: ↑Wed Jul 18, 2018 12:29 pm

noxiousdog wrote: ↑Wed Jul 18, 2018 9:12 am

In 2016 you paid $100 for $5.21 of earnings. Today if you paid $100, you get $8.68.

I'm not getting those earnings.

I'm getting a monthly decrease in the value for selling my stock and $.50 per share per quarter.

Yes, you are. They legally belong to you.

$0.50/share/Q is about $3/$100 of stock/Year. So they're returning a lot to you.

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Thu Jul 26, 2018 11:38 am

by LordMortis

LawBeefaroni wrote: ↑Fri Jun 15, 2018 9:51 am

And God help me, I'm about to buy more Ford.

I'm at that Rubicon as Ford hits $10. Fortunately(?) I've managed to tie up most of my money in CDs so I can't fall prey to that temptation. This Tariff talk, man if only I had money, I could clean up on US "deals" and social media driving markets. At least until one of the deals and twitters justice actually puts a fortune 500 company under.

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Thu Jul 26, 2018 1:14 pm

by pr0ner

I dunno how I would feel about investing in F right now. Probably why I've never put money into an auto manufacturer before.

On the other hand, I am certainly wondering whether I want to put some money in FB after its huge earnings related drop today.

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Thu Jul 26, 2018 1:21 pm

by LordMortis

That's the thing. I have enough (too much) money in auto and in the oil based economy. At the current $9.96 a share = nearly 6.02% dividends and p/e of 5.42.

I don't see Ford going under due to "disruption" in the foreseeable future.

If we break the world economy with shenanigans, we're all fucked anyway so this temptation is there.

And so it stares at me begging me to do something stupid.

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Thu Jul 26, 2018 3:46 pm

by LawBeefaroni

In for 1,000. So help me.

Also, my AMD calls would be like $8.50 today if I keep them. Sold after a "cool" double at like $4. I'm watching that this run and regretting selling, mostly because my original intent was to hedge selling my long shares. Should have stuck to that.

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Thu Jul 26, 2018 6:02 pm

by pr0ner

I assume that's 1,000 shares of F and not FB, Lawbeef?

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Thu Jul 26, 2018 6:12 pm

by pr0ner

Watching AMZN today in light of the FB news is hilarious. The stock lost $55.61 a share today. After reporting earnings, it's currently up $58.55 after hours.

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Thu Jul 26, 2018 10:23 pm

by LawBeefaroni

Yeah, Ford.

AMZN settled around $1860 at the end of AH.

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Fri Jul 27, 2018 8:58 am

by pr0ner

LawBeefaroni wrote: ↑Thu Jul 26, 2018 10:23 pm

Yeah, Ford.

AMZN settled around $1860 at the end of AH.

AMZN up even more pre market - looks like it's going to open in the $1880-$1885 range or so.

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Tue Jul 31, 2018 12:21 pm

by Isgrimnur

So doing some quick calculations, I'm getting 11% of my salary (on some calculation, unknown if it's snapshot or previous year average) in pension as of my anniversary date (5 year mark, full vesting is in <2 months). I have my Roth IRA contributions now maxed for >5%/year savings, and another ~1.5% just added to my extremely limited no-match 401k options, with a significant room for expansion of that over time.

So that's >16% per year in raw savings, with >6% being in investment vehicles.

And seeing as I don't see being able to retire for another 25+ years...

Anyone want to point me to the math as to what percentage of match and long-term average growth I'd need on a 401k offering to offset 11% lump sum deposits?

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Tue Jul 31, 2018 4:01 pm

by noxiousdog

Isgrimnur wrote: ↑Tue Jul 31, 2018 12:21 pm

So doing some quick calculations, I'm getting 11% of my salary (on some calculation, unknown if it's snapshot or previous year average) in pension as of my anniversary date (5 year mark, full vesting is in <2 months). I have my Roth IRA contributions now maxed for >5%/year savings, and another ~1.5% just added to my

extremely limited no-match 401k options, with a significant room for expansion of that over time.

So that's >16% per year in raw savings, with >6% being in investment vehicles.

And seeing as I don't see being able to retire for another 25+ years...

Anyone want to point me to the math as to what percentage of match and long-term average growth I'd need on a 401k offering to offset 11% lump sum deposits?

I'm not sure what you're asking.

If it is how long does it take 1% of today's salary in a 401k to equal 11% of today's value, it's roughly 37 years assuming the historical growth rates of the s&p 500 with no matching.

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Tue Jul 31, 2018 4:03 pm

by noxiousdog

Oh. I think I know what you mean, but what happens to the 11% lump sum deposits? Do they just grow with inflation?

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Tue Jul 31, 2018 4:15 pm

by Isgrimnur

To the best of my knowledge, they do not.

The pension plan is funded entirely by the employer making contributions on your behalf equal to approximately 11% of your annual salary. You are 0% vested until you complete your fifth year of service and then you are 100% vested. There is nothing for you to choose, nothing for you to manage, nothing for you to pay out of your bi-weekly pay check. Your benefit at retirement is calculated using a percentage of an average monthly income times the number of years of benefit service to get a monthly payout from a Straight Life Annuity. Your benefit can be taken in one of several forms. If you leave the Credit Union prior to retirement, your vested amount can be rolled over into one of several tax-deferred instruments or withdrawn.

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Tue Jul 31, 2018 4:24 pm

by LordMortis

Isgrimnur wrote: ↑Tue Jul 31, 2018 4:15 pm

To the best of my knowledge, they do not.

The pension plan is funded entirely by the employer making contributions on your behalf equal to approximately 11% of your annual salary. You are 0% vested until you complete your fifth year of service and then you are 100% vested. There is nothing for you to choose, nothing for you to manage, nothing for you to pay out of your bi-weekly pay check. Your benefit at retirement is calculated using a percentage of an average monthly income times the number of years of benefit service to get a monthly payout from a Straight Life Annuity. Your benefit can be taken in one of several forms. If you leave the Credit Union prior to retirement, your vested amount can be rolled over into one of several tax-deferred instruments or withdrawn.

That's a sweet gig. Now that I have a better understanding of what you were getting at I don't think there's a comparison. So in two months if you walk away you will get 5% of your average monthly income for the rest of your life or you can take an 11% of your total salary accumulated and dump in a traditional IRA? And that's separate from your salary.

I want that.

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Tue Jul 31, 2018 4:30 pm

by noxiousdog

Isgrimnur wrote: ↑Tue Jul 31, 2018 4:15 pm

To the best of my knowledge, they do not.

The pension plan is funded entirely by the employer making contributions on your behalf equal to approximately 11% of your annual salary. You are 0% vested until you complete your fifth year of service and then you are 100% vested. There is nothing for you to choose, nothing for you to manage, nothing for you to pay out of your bi-weekly pay check. Your benefit at retirement is calculated using a percentage of an average monthly income times the number of years of benefit service to get a monthly payout from a Straight Life Annuity. Your benefit can be taken in one of several forms. If you leave the Credit Union prior to retirement, your vested amount can be rolled over into one of several tax-deferred instruments or withdrawn.

It should be roughly inflation.

The math is (.11 - m) = p (1*r)^(t) where m is the 401k matching %, r is the rate (use .07) p is the 401(k) contribution percentage with match and t is the number of years.

At a 100% match on 3% 401(k) contribution percentage, it would take 4 years to match the 11% lump. Inflation cancels out. That's also conservative because the 7% rate is the historical real return of the S&P 500, not inflation adjusted.

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Tue Jul 31, 2018 4:38 pm

by LawBeefaroni

I had a similar pension at my old job. Only payout was based on total contribution, not salary. It had a minimum annual rate of 2.5% and was like 140% funded. The problem was, they froze it like my 4th year there so my total was like $40k after 19 years. I rolled that when I left. I think it calculated out to like $350/month upon retirement. Nothing to sneeze at but I figured it would be better elsewhere.

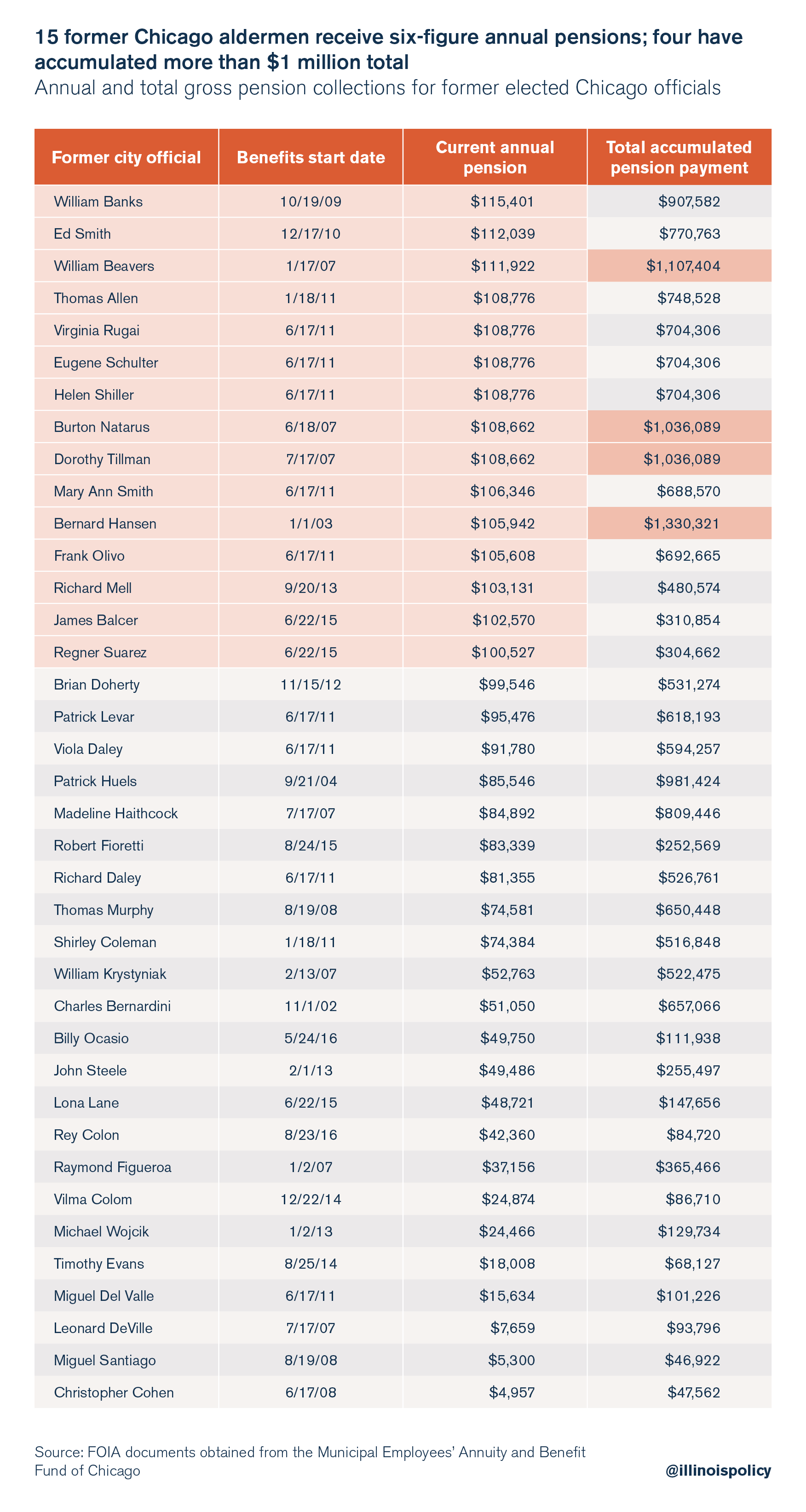

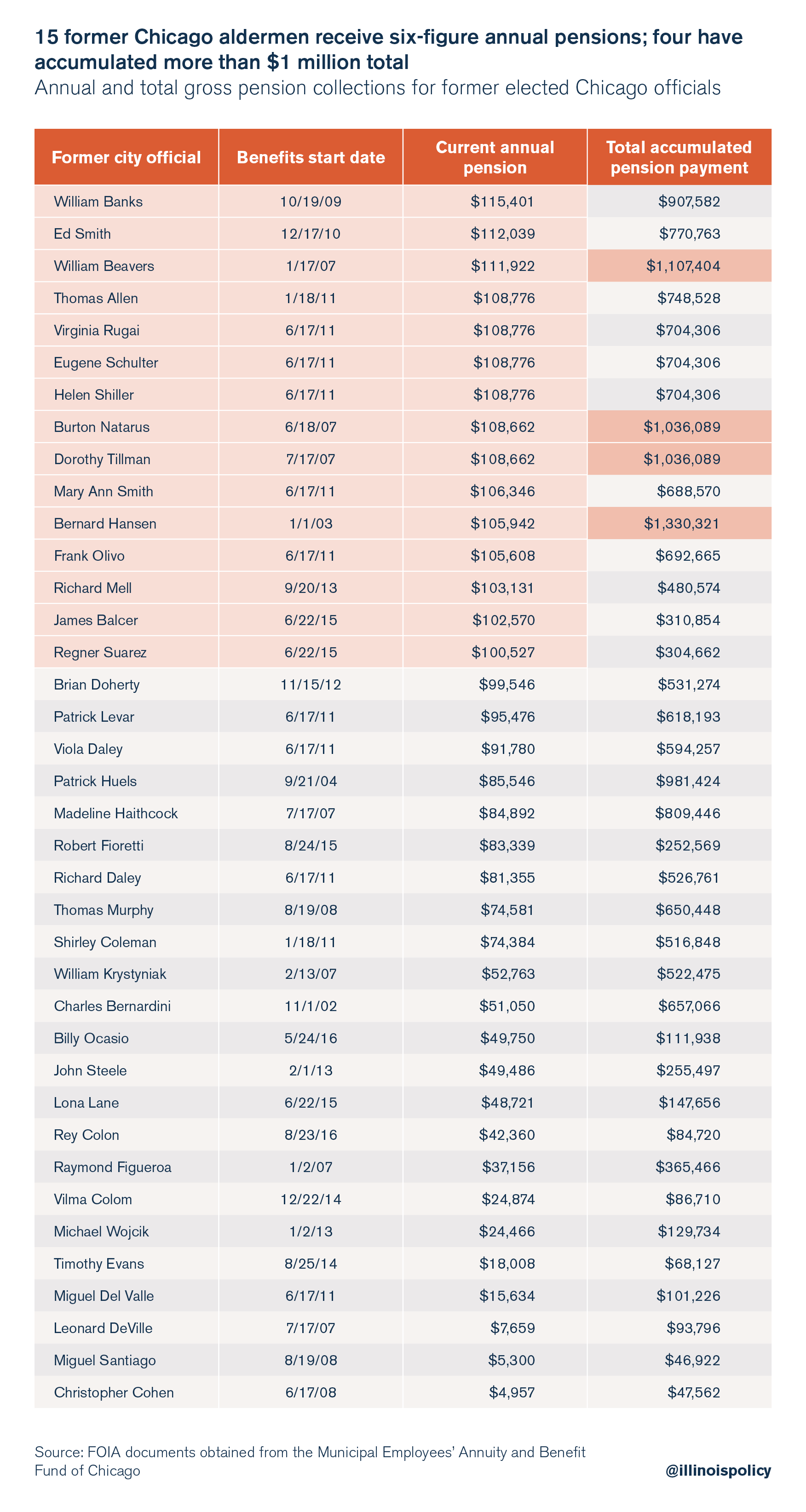

Maybe I'll just run for an

alderman spot. Take the part time job, keep my current job, get kickbacks, get fat pension.

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Thu Aug 09, 2018 3:59 pm

by Isgrimnur

Rite Aid/Albertson's

Rite Aid shares plunged Thursday as the company headed into an uncertain future after calling off its merger with the grocer Albertsons.

Analysts and retail insiders questioned the drugstore chain's prospects after it ended a planned takeover by Albertsons before Rite Aid shareholders could vote on it. That vote also faced shaky prospects due to opposition from shareholders and influential proxy advisory firms.

Rite Aid Chairman and CEO John Standley said in a prepared statement that his company would continue to "build momentum" for big parts of its business like its renovated stores, expanded pharmacy services and its customer loyalty program. Rite Aid also said its board will consider governance changes, although it did not elaborate.

The company also has a pharmacy benefit management, or PBM, operation that runs prescription drug coverage and diversifies its business. But Rite Aid is down to around 2,500 stores mostly on the East and West coasts after selling nearly 2,000 to bigger rival Walgreens Boots Alliance Inc. And it doesn't operate one of the nation's largest PBMs like another competitor, CVS Health Corp.

Rite Aid Corp. has neither "the scale nor the balance sheet to compete with much larger and well-capitalized rivals," Moody's Vice President Mickey Chadha said in an email.

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Mon Aug 20, 2018 10:40 am

by Carpet_pissr

Just came across this resource, and thought I would share:

https://www.fidelity.com/webcontent/ap0 ... rd_current

It's a link to a Fidelity PDF wherein they monitor various firms' "picking" performance, for buying, selling, and combined. Ford research scored surprisingly well. I am sure there's a more updated version of this, but thought it was super interesting. I love meta data like this. Note the data was not compiled by Fidelity, I think they just must host it on their site for clients as another research tool. INVESTARS appears to be the company that actually runs the data.

I was specifically looking up some indication of CFRA's track record in the past year or two, if anyone has input on that service?

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Mon Aug 20, 2018 11:36 am

by noxiousdog

Carpet_pissr wrote: ↑Mon Aug 20, 2018 10:40 am

Just came across this resource, and thought I would share:

https://www.fidelity.com/webcontent/ap0 ... rd_current

It's a link to a Fidelity PDF wherein they monitor various firms' "picking" performance, for buying, selling, and combined. Ford research scored surprisingly well. I am sure there's a more updated version of this, but thought it was super interesting. I love meta data like this. Note the data was not compiled by Fidelity, I think they just must host it on their site for clients as another research tool. INVESTARS appears to be the company that actually runs the data.

I was specifically looking up some indication of CFRA's track record in the past year or two, if anyone has input on that service?

Nice find. Thanks.

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Mon Aug 20, 2018 11:47 am

by noxiousdog

noxiousdog wrote: ↑Tue Jul 17, 2018 3:20 pm

Carpet_pissr wrote: ↑Fri Jun 29, 2018 4:09 pm

I went to about 30% cash a week or so ago...sold a few shares of AMZN as well as CVS. Looks like a great buying opportunity for CVS, IF you believe, like many analysts do, that AMZN can't possibly "solve" a problem like healthcare. I honestly don't know. I know that it's not like breaking into retail, or media content. It's a whole 'nother beast, with relationships at high levels required, etc.

We'll see.

Thank you for the CVS mention. It's trading at 13.5 times 2017 earnings with decent growth expectations. Even a modest multiple gain to 15 would give a 56% return by 2018 earnings season.

This is working well.

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Mon Aug 20, 2018 11:52 am

by Carpet_pissr

noxiousdog wrote: ↑Mon Aug 20, 2018 11:47 am

noxiousdog wrote: ↑Tue Jul 17, 2018 3:20 pm

Carpet_pissr wrote: ↑Fri Jun 29, 2018 4:09 pm

I went to about 30% cash a week or so ago...sold a few shares of AMZN as well as CVS. Looks like a great buying opportunity for CVS, IF you believe, like many analysts do, that AMZN can't possibly "solve" a problem like healthcare. I honestly don't know. I know that it's not like breaking into retail, or media content. It's a whole 'nother beast, with relationships at high levels required, etc.

We'll see.

Thank you for the CVS mention. It's trading at 13.5 times 2017 earnings with decent growth expectations. Even a modest multiple gain to 15 would give a 56% return by 2018 earnings season.

This is working well.

Which part?

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Mon Aug 20, 2018 11:56 am

by Carpet_pissr

Here's an interesting article on Amazon's impact (or lack thereof) on retail pharmacies:

https://www.marketwatch.com/story/inves ... yptr=yahoo

I've mentioned this issue several times on the board, so always good to hear a decently reasoned counter-argument.

I'm still long on both my CVS and AMZN shares (also ESRX).

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Mon Aug 20, 2018 12:12 pm

by noxiousdog

Carpet_pissr wrote: ↑Mon Aug 20, 2018 11:52 am

noxiousdog wrote: ↑Mon Aug 20, 2018 11:47 am

noxiousdog wrote: ↑Tue Jul 17, 2018 3:20 pm

Carpet_pissr wrote: ↑Fri Jun 29, 2018 4:09 pm

I went to about 30% cash a week or so ago...sold a few shares of AMZN as well as CVS. Looks like a great buying opportunity for CVS, IF you believe, like many analysts do, that AMZN can't possibly "solve" a problem like healthcare. I honestly don't know. I know that it's not like breaking into retail, or media content. It's a whole 'nother beast, with relationships at high levels required, etc.

We'll see.

Thank you for the CVS mention. It's trading at 13.5 times 2017 earnings with decent growth expectations. Even a modest multiple gain to 15 would give a 56% return by 2018 earnings season.

This is working well.

Which part?

CVS is up over 10% from where I tagged along on your idea.

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Mon Aug 20, 2018 2:24 pm

by Carpet_pissr

noxiousdog wrote: ↑Mon Aug 20, 2018 12:12 pm

Carpet_pissr wrote: ↑Mon Aug 20, 2018 11:52 am

noxiousdog wrote: ↑Mon Aug 20, 2018 11:47 am

noxiousdog wrote: ↑Tue Jul 17, 2018 3:20 pm

Carpet_pissr wrote: ↑Fri Jun 29, 2018 4:09 pm

I went to about 30% cash a week or so ago...sold a few shares of AMZN as well as CVS. Looks like a great buying opportunity for CVS, IF you believe, like many analysts do, that AMZN can't possibly "solve" a problem like healthcare. I honestly don't know. I know that it's not like breaking into retail, or media content. It's a whole 'nother beast, with relationships at high levels required, etc.

We'll see.

Thank you for the CVS mention. It's trading at 13.5 times 2017 earnings with decent growth expectations. Even a modest multiple gain to 15 would give a 56% return by 2018 earnings season.

This is working well.

Which part?

CVS is up over 10% from where I tagged along on your idea.

Ah, good for you! I am currently down about 13% since I have been holding it. Lots of analysts with good track records like it here even, and expect it to continue to go up for a while (I have a 'soft' sell target of $90).

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Mon Aug 20, 2018 2:45 pm

by Carpet_pissr

Looks like we are about to come out of this long ass correction. Doubling my position in MCHP, and adding more AMZN. If I was being consistent, I would also buy more CVS here, but I can't make myself do that.

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Thu Sep 13, 2018 11:13 am

by LordMortis

Two year CDs look like they are going up about .1%, which how much my CU money market pays in total.

I know it's not very interesting but building a monthly two year CD ladder for a bit of a cushion at the expense of transferring over my savings cushion that has basically been an investment waste, waiting for me to suffer a major setback or buy a new car while building is all I've been doing for the last several months and may be all I do for the remainder of the year.

And so I watch CDs and bonds and treasuries and such for now. At least this bit of education won't actively cost me money like my other poor decisions. The only costs are opportunity costs. Hindsight lets me know how poor keeping my rainy day funds in a money marked was though. When everyone says CDs are crap but I can get a to year for 2.939% vs my money market of .1% as long as I'm willing to set up games to treat accessing my money like it's a an optional paycheck I have to play with once a month, I can live with that.

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Thu Sep 13, 2018 11:21 am

by LawBeefaroni

AMD is over $33 today. I closed out all my remaining positions around $18. Looking at $16k or so in missed gains in less than a month.

Might buy some AUO. Still researching.

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Thu Sep 13, 2018 11:27 am

by LordMortis

While I'm here, this should make ND happy

https://www.healthcareitnews.com/news/p ... healthcare

but I'm still down 22+% on my purchase price, which has not been made up dividends, much less taxable dividends.

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Thu Sep 13, 2018 11:33 am

by noxiousdog

I like the fact that there is a lot of competition in the sector. That makes me happy.