Page 12 of 57

Re: The Viral Economy

Posted: Fri Oct 23, 2020 12:47 pm

by LawBeefaroni

Just got word that the neighborhood dojo is shutting down. Kiddo is taking it very hard. They did online, which wasn't the same, and classes in the park but now with the weather that isn't possible anymore. They have another location in the suburbs they is still open so they may yet survive but that's it for the kiddo. So far karate and archery done.

This feels like the second wave after the early restaurant/bar closures. I think reality is setting in for a lot of businesses that were just hanging on or burning through savings.

Re: The Viral Economy

Posted: Fri Oct 23, 2020 3:18 pm

by ImLawBoy

We've been doing virtual music lessons from

Music House and they seem to be doing OK. They've got a lot of artsy virtual offerings that might be worth looking into (although probably not martial artsy).

Re: The Viral Economy

Posted: Fri Oct 23, 2020 3:43 pm

by LawBeefaroni

ImLawBoy wrote: ↑Fri Oct 23, 2020 3:18 pm

We've been doing virtual music lessons from

Music House and they seem to be doing OK. They've got a lot of artsy virtual offerings that might be worth looking into (although probably not martial artsy).

We're still doing virtual music from

Alex's, thank goodness. They appear to be surviving. I think since music is more often based on 1-on-1 lessons they translate much better to virtual.

Re: The Viral Economy

Posted: Tue Oct 27, 2020 8:59 am

by LawBeefaroni

Stimulus postponed again for the sake of political ambitions.

And

we're just getting started:

Bankruptcy filings are surging due to the economic fallout of COVID-19, and many lenders are coming to the realization that their claims are almost completely worthless. Instead of recouping, say, 40 cents for every dollar owed, as has been the norm for years, unsecured creditors now face the unenviable prospect of walking away with just pennies, if that.

Debt issued by the owner of Men’s Wearhouse, which filed for court protection in August, traded this month for less than 2 cents on the dollar. When J.C. Penney Co. went bankrupt, an auction held for holders of default protection found the retailer’s lowest-priced debt was worth just 0.125 cents on the dollar. For Neiman Marcus Group Inc., that figure was 3 cents.

The loose lending terms that investors have agreed to mean that by the time corporations file for bankruptcy now, they’ve often exhausted their options for fixing their debt loads out of court. They’ve swapped their old notes for new ones, often borrowing against even more of their assets in the process. Some have taken brand names, trademarks and even whole businesses out of the reach of existing creditors and borrowed against those too. While creditors always do worse in economic downturns than in better times, in previous downturns, lenders had more power to press companies into bankruptcy sooner, stemming some of their losses.

Re: The Viral Economy

Posted: Sat Oct 31, 2020 12:07 am

by Dave Allen

I predict if Trump loses the election, the stock market will tank.

Value the continuation of goods and services? Vote appropriately.

Re: The Viral Economy

Posted: Sat Oct 31, 2020 12:13 am

by pr0ner

Dave Allen wrote: ↑Sat Oct 31, 2020 12:07 am

I predict if Trump loses the election, the stock market will tank.

Value the continuation of goods and services? Vote appropriately.

This is like reverse Drazzil.

Re: The Viral Economy

Posted: Sat Oct 31, 2020 12:14 am

by Kraken

Investors are already pricing in a Biden victory. The economy can't recover until the pandemic is brought to heel, and trump is not even trying to do that.

Re: The Viral Economy

Posted: Sat Oct 31, 2020 12:15 am

by RunningMn9

Dave Allen wrote:I predict if Trump loses the election, the stock market will tank.

Value the continuation of goods and services? Vote appropriately.

Right. Goods and services aren’t going to continue.

Re: The Viral Economy

Posted: Sat Oct 31, 2020 12:25 am

by Dave Allen

RunningMn9 wrote: ↑Sat Oct 31, 2020 12:15 am

Dave Allen wrote:I predict if Trump loses the election, the stock market will tank.

Value the continuation of goods and services? Vote appropriately.

Right. Goods and services aren’t going to continue.

I want to be clear. I voted for Biden, but it will have its consequences.

Re: The Viral Economy

Posted: Sat Oct 31, 2020 12:37 am

by Alefroth

Dave Allen wrote: ↑Sat Oct 31, 2020 12:25 am

RunningMn9 wrote: ↑Sat Oct 31, 2020 12:15 am

Dave Allen wrote:I predict if Trump loses the election, the stock market will tank.

Value the continuation of goods and services? Vote appropriately.

Right. Goods and services aren’t going to continue.

I want to be clear. I voted for Biden, but it will have its consequences.

None of which are goods and services stopping.

Re: The Viral Economy

Posted: Sat Oct 31, 2020 12:41 am

by Isgrimnur

It's sort of the point.

Re: The Viral Economy

Posted: Sat Oct 31, 2020 12:42 am

by Little Raven

The stock market is increasingly detached from the actual economy anyway. I have no doubt it will take a hit....but I cannot imagine that it will have a substantial impact on actual goods and services.

COVID, on the other hand, very much will.

Re: The Viral Economy

Posted: Sat Oct 31, 2020 1:31 am

by Isgrimnur

2021 will bring massive impacts to both residential and business real estate if the government doesn't act. And given that the Senate decided to pass on relief before the election but after confirming Barrett, there's no doubt that, if there's action before inauguration day, it will be too little and too late.

Re: The Viral Economy

Posted: Sat Oct 31, 2020 10:03 am

by RunningMn9

Dave Allen wrote:I want to be clear. I voted for Biden, but it will have its consequences.

That’s true, but those consequences will be to stop pretending that the economy is going great, and that the pandemic is ending - and to start doing things about the economy and actually ending the pandemic.

The stock market is a mirage right now and has been for quite some time. The bubble was always going to burst, sooner or later, and it will always be better for the bubble to pop sooner.

Re: The Viral Economy

Posted: Sat Oct 31, 2020 10:30 am

by malchior

RunningMn9 wrote: ↑Sat Oct 31, 2020 10:03 am

Dave Allen wrote:I want to be clear. I voted for Biden, but it will have its consequences.

That’s true, but those consequences will be to stop pretending that the economy is going great, and that the pandemic is ending - and to start doing things about the economy and actually ending the pandemic.

The stock market is a mirage right now and has been for quite some time. The bubble was always going to burst, sooner or later, and it will always be better for the bubble to pop sooner.

It is really looking like there isn't much of a bubble to pop in many sectors. Many American Corporations actually had great quarters/years. What it shows is that "American Corporations" aren't American things anymore - they are global entities that are somewhat disconnected from the Main Street economy. Their exposure is limited. They spent the last 10 years diversifying themselves away from Main Street connectivity but still get all the benefits from the tax code and Uncle Sam's totally not socialist* support of them.

*Not socialist - since there is no term for when they take our tax money and distribute it to the wealthiest in normal times and especially during a pandemic. It is sort of kleptocratic but not in the way it is in China...yet.

Re: The Viral Economy

Posted: Sat Oct 31, 2020 12:45 pm

by RunningMn9

The bubble has nothing to do with whether multinational corporations had good years. The problem is that their valuations are out of whack.

Re: The Viral Economy

Posted: Sat Oct 31, 2020 1:19 pm

by LawBeefaroni

You also have a handful of companies with insane valuations as strength begets strength. Something like the top 5 S&P500 companies have a valuation equal to the bottom 300. There is a corporate wealth gap similar to the personal wealth gap.

Re: The Viral Economy

Posted: Sat Oct 31, 2020 1:48 pm

by malchior

RunningMn9 wrote: ↑Sat Oct 31, 2020 12:45 pm

The bubble has nothing to do with whether multinational corporations had good years. The problem is that their valuations are out of whack.

Right but to Lawbeefaroni's point, it is likely mostly due to a few valuations out of whack. There are a few companies (I'm staring right at Tesla) that look completely unmoored from reality right now. It is a pretty small group and it is artificially making the whole basket look over-priced. It isn't broad-based. If you bought the basket, we very well might see decline in the valuations of the top players and find money flowing to other investment opportunities in the basket. My point was that many valuations are not out of terribly out of whack *especially* when you cross off the "one-percenter" effect that is happening right now.

This isn't a bubble like pets.com era where you had loads of stocks with no or negative earnings with investors piling in with reckless disregard. Instead, what we're seeing is that there are a lot of companies showing unexpected strength. Some services companies had unexpected blow out quarters. All big 4 consulting firms + Accenture, Tata, BAH, etc. Even in a year with an oil price crash some oil services firms (e.g. Baker Hughes) did well. There isn't much of the softness we'd expect from a recession.

Re: The Viral Economy

Posted: Sat Oct 31, 2020 1:58 pm

by LawBeefaroni

malchior wrote: ↑Sat Oct 31, 2020 1:48 pm

RunningMn9 wrote: ↑Sat Oct 31, 2020 12:45 pm

The bubble has nothing to do with whether multinational corporations had good years. The problem is that their valuations are out of whack.

Right but to Lawbeefaroni's point, it is likely mostly due to a few valuations out of whack. There are a few companies (I'm staring right at Tesla) that look completely unmoored from reality right now. It is a pretty small group and it is artificially making the whole basket look over-priced. It isn't broad-based. If you bought the basket, we very well might see decline in the valuations of the top players and find money flowing to other investment opportunities in the basket. My point was that many valuations are not out of terribly out of whack *especially* when you cross off the "one-percenter" effect that is happening right now.

This isn't a bubble like 2000/2001 where you had loads of stocks with no or negative earnings with investors piling in with reckless disregard. Instead, what we're seeing is that there are a lot of companies showing unexpected strength. Some services companies had unexpected blow out quarters. All big 4 consulting firms + Accenture, Tata, BAH, etc. Even in a year with an oil price crash some oil services firms (e.g. Baker Hughes) did well. There isn't much of the softness we'd expect from a recession.

The problem, though, is that when the valuations start reflecting reality there will be ripples everywhere. You won't see a "flight to safety", you'll probably see margin calls and massive sell offs. And this will be against a backdrop of surging bankruptcies with record low recovery rates, panicked consumers, and historic economic inequity.

I mean weird things are happening.

Re: The Viral Economy

Posted: Sat Oct 31, 2020 2:27 pm

by malchior

Yeah - I personally expect the stock market be flat for -- well a few years -- but that's pretty difference from a big bubble. This entire year has been what? 2-3% up. YoY maybe 5%. It's underperforming but you sort to have to expect that.

Re: The Viral Economy

Posted: Sat Oct 31, 2020 2:30 pm

by Smoove_B

Wait until the higher education bubble bursts over the next year.

Re: The Viral Economy

Posted: Sat Oct 31, 2020 2:39 pm

by LawBeefaroni

Smoove_B wrote: ↑Sat Oct 31, 2020 2:30 pm

Wait until the higher education bubble bursts over the next year.

And/or the $1.6T student loan debt liability.

Re: The Viral Economy

Posted: Sat Oct 31, 2020 2:45 pm

by LawBeefaroni

And BTC hit $14K today.

Re: The Viral Economy

Posted: Sat Oct 31, 2020 2:47 pm

by malchior

Smoove_B wrote: ↑Sat Oct 31, 2020 2:30 pm

Wait until the higher education bubble bursts over the next year.

Oh there will be a reckoning there but what we learned from the multiple financial crises is that banking system failures don't have to be economy-wide failures. Same thing in real-estate in general. There will be massive pain points there unless people get support. That is why the negligence from McConnell is so galling. This is what government is good for. Backstopping immediate financial system crises to prevent them from damaging the overall economy.

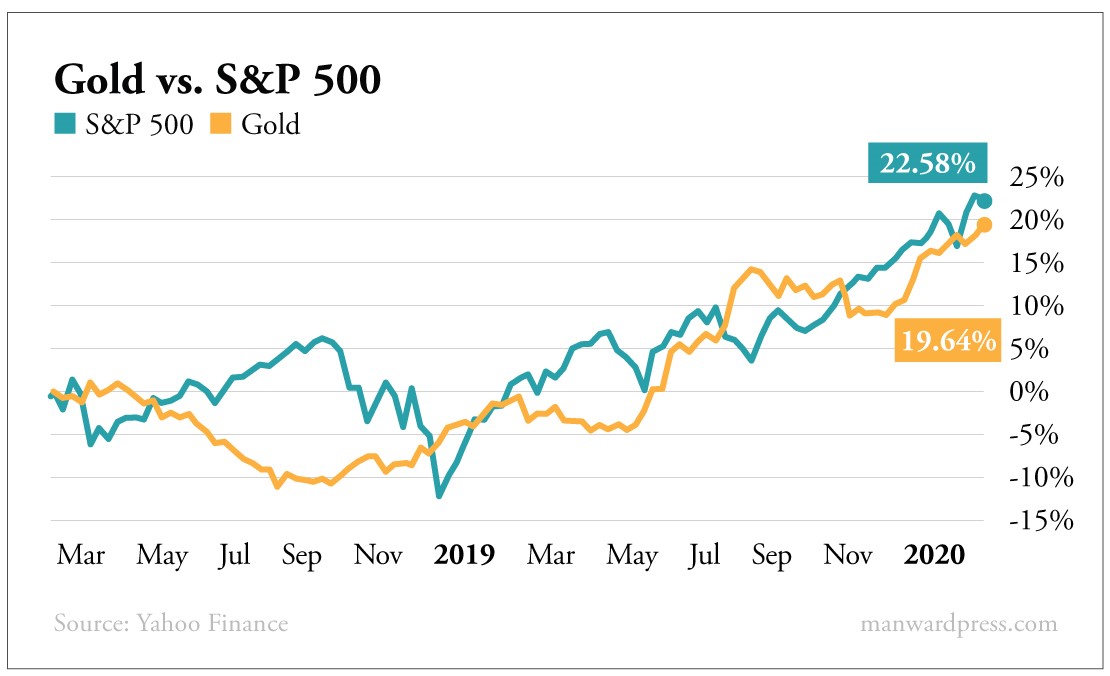

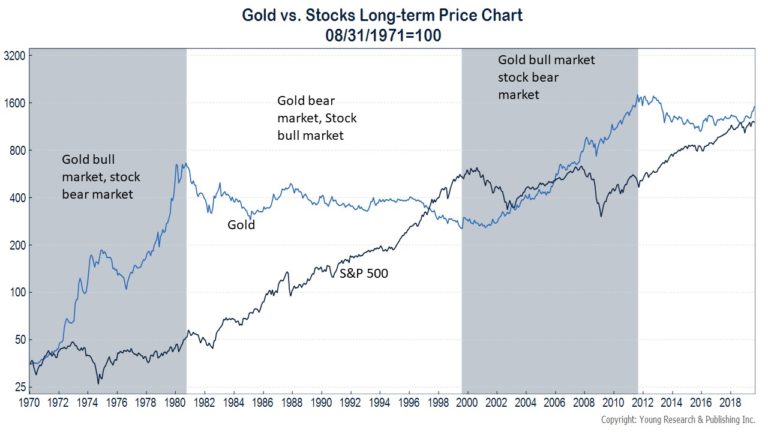

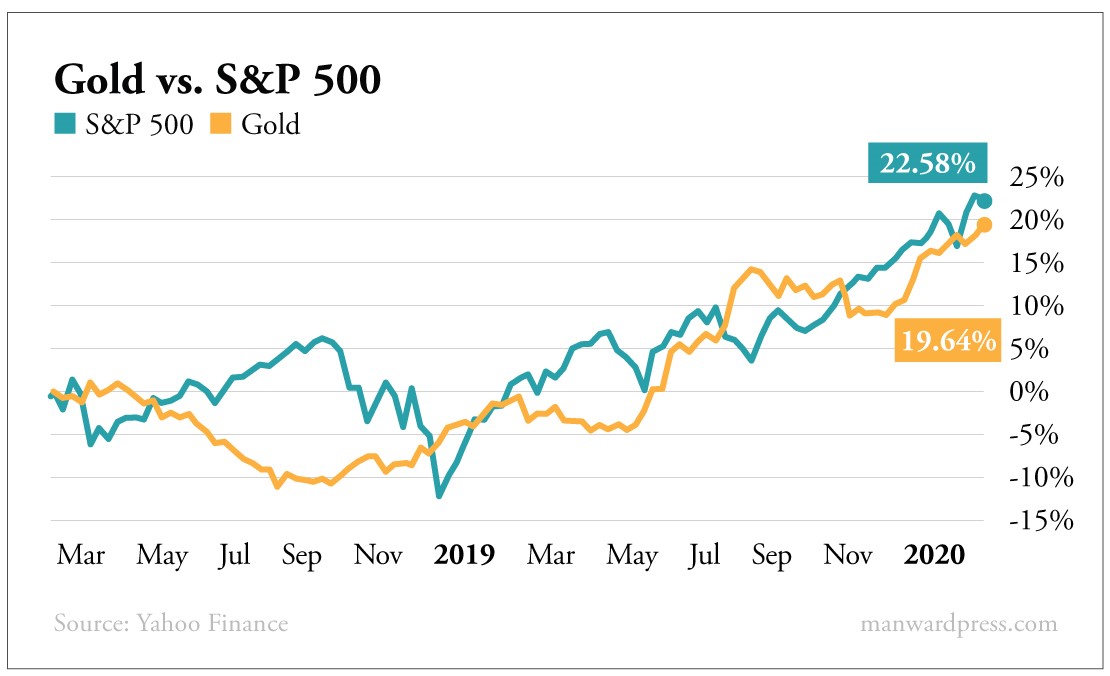

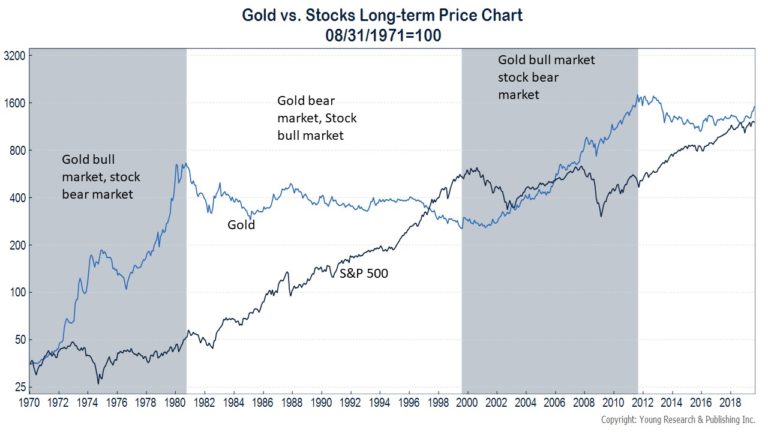

The interesting thing is you can see how the market is decoupled in the results in the graphs above. You can fit a really nice line to that graph up and to the right on the S&P 500. The 'fitted line' for growth cuts high above the 70s where the market was undervalued, way under the price trend through the late 90s to early 00s bubble, somewhat through what was almost a purely financial crisis in 2008, and skims through the entire decade afterwards. If I was to get all technocratic, high frequency trading as maligned as it is enabled pretty good price discovery throughout the last decade and kept the market in line with the "secular" long-term growth line. Especially as companies diversified themselves across global markets. That said, we'll see a global growth shutdown due to the pandemic and growth overall will slow everywhere. It is expected but we don't have good line of sight on any wide-scale imbalance that'll wreck everything. Big, big *but* here though -- this probably depends on the Fed not bowing to a fucking moron making idiotic political demands that'll undermine confidence and not react properly to problems.

Re: The Viral Economy

Posted: Tue Nov 10, 2020 1:09 pm

by LawBeefaroni

Boomers:

Much has been said of the expected $68 trillion wealth transfer as boomers leave their wealth to the next generation. Now it appears some of that wealth may evaporate amid the crisis.

“People hear these numbers and think of the stock market or real estate, but a large chunk of that is around small- and mid-sized family businesses,” said Andrew Sherman, partner at Seyfarth Shaw in Washington, D.C.

With businesses suffering and unemployment up, savings are falling accordingly. The number of boomers who report having retirement or savings accounts has declined in the crisis. According to the Center for the New Middle class, only 20% of nonprime boomers said they had retirement accounts, down from 36% a year ago. Even wealthier boomers saw savings drop, with 38% of boomers with prime credit ratings saying they have retirement accounts, down from 45% a year ago.

Re: The Viral Economy

Posted: Wed Nov 11, 2020 8:37 pm

by Smoove_B

It's like the thread title was made just for

this article:

The Chairman and CEO of Pfizer, Albert Bourla, sold $5.6 million worth of stock in the pharmaceutical company on Monday. The sale took place on the same day Pfizer announced that its experimental coronavirus vaccine candidate was found to be more than 90% effective. The company's stock soared on the news.

Bourla sold the stock as part of a stock trading plan that aims to shield corporate executives from allegations of illegal insider trading. But these plans have become increasingly controversial and the issue has taken on added urgency given the billions of dollars the government has promised Pfizer if its vaccine meets the approval of federal regulators.

Re: The Viral Economy

Posted: Wed Nov 11, 2020 8:39 pm

by LawBeefaroni

He's way back in line behind Kodak, Moderna, Tesla...

Re: The Viral Economy

Posted: Wed Nov 11, 2020 8:43 pm

by Max Peck

So the timing of the press release was about the scheduled stock sale, not the election?

Re: The Viral Economy

Posted: Wed Nov 11, 2020 8:51 pm

by malchior

Oh...so Trump got out grifted.

Re: The Viral Economy

Posted: Wed Nov 11, 2020 8:55 pm

by LawBeefaroni

"Planned" stock sales are bullshit. They're is no mechanism to force the sale. If the price is good, sell. If not, don't. For all we know he had a planned sale every day since mid-October. He just actually sold on the pop.

Re: The Viral Economy

Posted: Wed Nov 11, 2020 9:03 pm

by malchior

LawBeefaroni wrote: ↑Wed Nov 11, 2020 8:55 pm

"Planned" stock sales are bullshit. They're is no mechanism to force the sale. If the price is good, sell. If not, don't. For all we know he had a planned sale every day since mid-October. He just actually sold on the pop.

Yup. I mean the SEC would probably frown on that frequency since it is obviously gaming the rule. But it's technically formulaic so set a series of dates...and if the formula matches the plan executes. Sale on a big pop is an easy one to game out. It's just a pure coincidence that they released big positive news the day his plan could execute? Bullshit. They are pretty much straight up a white wash of insider trading.

Re: The Viral Economy

Posted: Wed Nov 11, 2020 9:37 pm

by Freyland

Could someone explain to an ignorant person (me) how this was actually wrong?

Man owns stocks. Stock price goes up because his company has something potentially valuable. Man sells stocks.

It seems no different than if I own the stocks and then sold it because they jumped in value.

It would be more concerning to me knowing that he was abruptly buying stocks prior to the news, then sold them on the day of the announcement, knowing he could make a quick buck.

Re: The Viral Economy

Posted: Wed Nov 11, 2020 9:40 pm

by Smoove_B

Let's pretend it turns out that after scientists get their hands on the data (which to my knowledge hasn't been released yet) it turns out that the claims of 90% success rate aren't quite true. Or as other scientists try to replicate their reported results, they're not coming anywhere close.

Do you want to be the CEO that coincidentally sold his stock the day the 90% news was release or when it's determined that the success rate is no where near that value? Or that he's the CEO of a corporation that suddenly doesn't have the magic bullet that was reported in a press release?

Maybe it really is totally a coincidence (it's not) - but maybe it is. The optics (coincidence or not) are terrible.

Re: The Viral Economy

Posted: Wed Nov 11, 2020 10:00 pm

by LawBeefaroni

Freyland wrote: ↑Wed Nov 11, 2020 9:37 pm

Could someone explain to an ignorant person (me) how this was actually wrong?

Man owns stocks. Stock price goes up because his company has something potentially valuable. Man sells stocks.

It seems no different than if I own the stocks and then sold it because they jumped in value.

He knew when and why it would jump in value. That's the difference.

It's a bad look. It's legal because there are workarounds but it's still a bad look. Don't worry, nothing will happen to him or his profits.

Re: The Viral Economy

Posted: Wed Nov 11, 2020 11:18 pm

by Freyland

Not concerned specifically about his wellbeing. Looking for understanding.

LawBeefaroni, you didn't explicitly agree with what Smoove said; is there more to it than his explanation? I can see where he is going, there. In your response, I could still see a common man taking the exact same path of seeing the jump and then selling.

Re: The Viral Economy

Posted: Wed Nov 11, 2020 11:22 pm

by malchior

Freyland wrote: ↑Wed Nov 11, 2020 11:18 pm

Not concerned specifically about his wellbeing. Looking for understanding.

LawBeefaroni, you didn't explicitly agree with what Smoove said; is there more to it than his explanation? I can see where he is going, there. In your response, I could still see a common man taking the exact same path of seeing the jump and then selling.

The common man isn't in a position to direct the timing of the press release that'll cause the big jump unlike the CEO who has a 'program' that has a known window and a metric for executing a trade. It's supposed to be 'arms length' but it is tenuous at best.

Re: The Viral Economy

Posted: Thu Nov 12, 2020 5:35 pm

by LawBeefaroni

The boy's daycare is closed until 11/30 due to COVID cases. Why this thread? Because that's an extra $350/week that will get pumped into the local liquor store economy. Probably mostly wine for the wife.

Re: The Viral Economy

Posted: Fri Nov 13, 2020 10:29 am

by Smoove_B

I mean, I guess this is one way to look at

things:

Fritze, an Indianapolis accountant, is among millions of Americans who have squirreled away their money in savings this year as the coronavirus pandemic has put an end to many activities — like going to the gym, restaurants or bars — that were common before the pandemic.

The savings reach $2 trillion, or roughly 10% of the economy. With a successful vaccine, all that money could be steered toward spending, according to economist Ian Shepherdson, ushering in what he calls the "Biden Boom" by the time spring arrives.

"President-elect Biden is arriving in Washington at the right time," said Shepherdson, who's the chief economist at Pantheon Macroeconomics. "The COVID news at the point where he's inaugurated is likely to be horrific. But it won't be for much longer after that."

...

Prakken thinks it will be two more years before Americans spend on travel, entertainment and other services at pre-pandemic levels.

What's more, even when a vaccine is widely available, it may take time before people feel safe going out and spending money again.

"It would be great in 2021 if all the venues were up and operating again and we could go see some bands," said Pittsburgh librarian Dana Farabaugh. "But I think it's going to be a while before, mentally, I feel OK being in a crowd of people like that again, not wearing masks."

Re: The Viral Economy

Posted: Fri Nov 13, 2020 11:02 am

by LordMortis

Smoove_B wrote: ↑Fri Nov 13, 2020 10:29 am

I mean, I guess this is one way to look at

things:

Fritze, an Indianapolis accountant, is among millions of Americans who have squirreled away their money in savings this year as the coronavirus pandemic has put an end to many activities — like going to the gym, restaurants or bars — that were common before the pandemic.

The savings reach $2 trillion, or roughly 10% of the economy. With a successful vaccine, all that money could be steered toward spending, according to economist Ian Shepherdson, ushering in what he calls the "Biden Boom" by the time spring arrives.

"President-elect Biden is arriving in Washington at the right time," said Shepherdson, who's the chief economist at Pantheon Macroeconomics. "The COVID news at the point where he's inaugurated is likely to be horrific. But it won't be for much longer after that."

...

Prakken thinks it will be two more years before Americans spend on travel, entertainment and other services at pre-pandemic levels.

What's more, even when a vaccine is widely available, it may take time before people feel safe going out and spending money again.

"It would be great in 2021 if all the venues were up and operating again and we could go see some bands," said Pittsburgh librarian Dana Farabaugh. "But I think it's going to be a while before, mentally, I feel OK being in a crowd of people like that again, not wearing masks."

I was reading yesterday that banks don't want your money. They are so flush with cash that even with interest rates of 0.01% they are losing money by holding all of this cash. I read it on the Internet while reviewing S&P news, so it must be true.

Re: The Viral Economy

Posted: Thu Nov 19, 2020 1:29 pm

by Isgrimnur

NPR

The day after Christmas, millions of Americans will lose their jobless benefits, according to a new study.

...

"Congress is set to cut off 12 million Americans from the only thing holding them back from falling into financial wreckage and disaster," says Andrew Stettner, a co-author of the new study from the progressive-leaning think tank the Century Foundation.